After purchasing Litecoin (LTC), your top priority should be securing your digital assets. The security of your Litecoin is only as strong as the method you use to store it. Understanding how to properly manage your cryptocurrency is essential for protecting your investment from theft and loss. True ownership of cryptocurrency means having exclusive control over your private keys.

This guide provides a foundational understanding of Litecoin wallets and the best practices for safe storage, empowering you to take charge of your assets.

Understanding Cryptocurrency Wallets

A cryptocurrency wallet does not store your coins in the traditional sense. Instead, it holds your private keys, which are critical pieces of information that prove your ownership and authorize transactions on the blockchain. If you own the private keys, you have full control over your funds.

The Importance of Private Keys

When you own cryptocurrencies, what you truly own is a private key. This secret code gives you access to your Litecoin and allows you to send it to others. Losing your private key means losing access to your funds forever. Conversely, anyone who gains access to your private key can control and steal your assets.

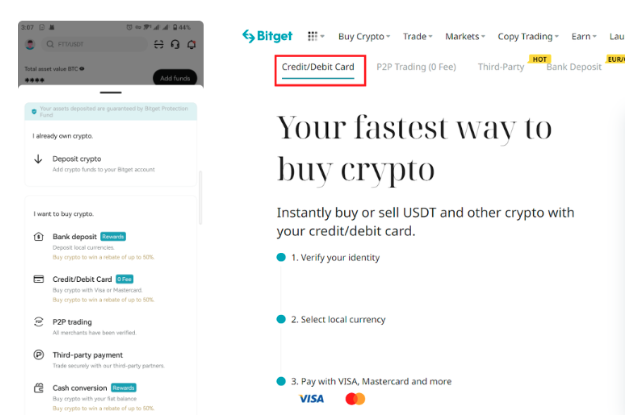

Many new investors purchase crypto on an exchange and leave it there. In this scenario, the exchange holds the private keys on your behalf. This is known as custodial storage. While convenient, it means you are entrusting a third party with your assets. For greater security and control, self-custody is the recommended approach.

Types of Litecoin Wallets

There are several types of wallets, each offering different levels of security and convenience. Choosing the right one depends on your needs, such as whether you plan to hold your Litecoin long-term or use it for frequent transactions.

Hardware Wallets

Often called cold wallets, hardware wallets are physical devices that store your private keys offline. They are considered one of the most secure ways to store cryptocurrency. By keeping your keys isolated from your internet-connected computer or smartphone, they provide a strong defense against hacking, malware, and phishing attacks.

These devices are a middle ground between the high security of deep cold storage and the convenience of software wallets. They are ideal for storing significant amounts of Litecoin for long-term investment. Transactions are signed within the device, ensuring the private key is never exposed.

Software Wallets

Software wallets, or hot wallets, are applications that you can install on your computer or mobile device. They are connected to the internet, which makes them more convenient for sending, receiving, and trading Litecoin quickly.

There are different kinds of software wallets:

* Desktop Wallets: These are installed on a desktop or laptop computer. Some, like the official Litecoin Core, function as a full node, meaning they download the entire blockchain. This offers greater privacy and sovereignty, as you verify transactions yourself.

* Mobile Wallets: These are apps for your smartphone, offering the convenience of managing your LTC on the go. They are typically lightweight clients that connect to the blockchain network without downloading its entire history.

While convenient, the online nature of software wallets makes them more vulnerable to security threats than hardware wallets.

Best Practices for Securing Your Litecoin

Regardless of the wallet you choose, following fundamental security practices is crucial for keeping your funds safe.

Safeguard Your Recovery Phrase

When you set up a non-custodial wallet, you will be given a recovery phrase, also known as a seed phrase. This is a list of 12 or 24 words that can be used to restore your wallet and access your funds if your device is lost, stolen, or damaged.

* Write down your recovery phrase and store it in a secure, offline location.

* Never store it digitally (e.g., in a photo, text file, or email).

* Consider creating multiple backups and storing them in different secure locations.

Never Share Your Private Keys

Your private keys and recovery phrase are the keys to your crypto. Never share them with anyone. Legitimate organizations and wallet providers will never ask for this information. Be extremely skeptical of any unsolicited message or individual requesting it.

Beware of Phishing Scams

Phishing is a common tactic used by scammers to steal cryptocurrency. They may create fake websites, emails, or messages impersonating legitimate services to trick you into revealing your sensitive information. Always double-check website URLs and be wary of suspicious links or unexpected requests.

After you learn how to buy litecoin, the next critical step is to transfer your assets to a secure wallet that you control. Leaving your coins on an exchange is risky, as moving them to a personal hardware or software wallet ensures that you, and only you, have control over your investment.